3 Things You Need to Know About Business Finances

Decentralized Finance vs. Traditional Finance: What You Need To Know

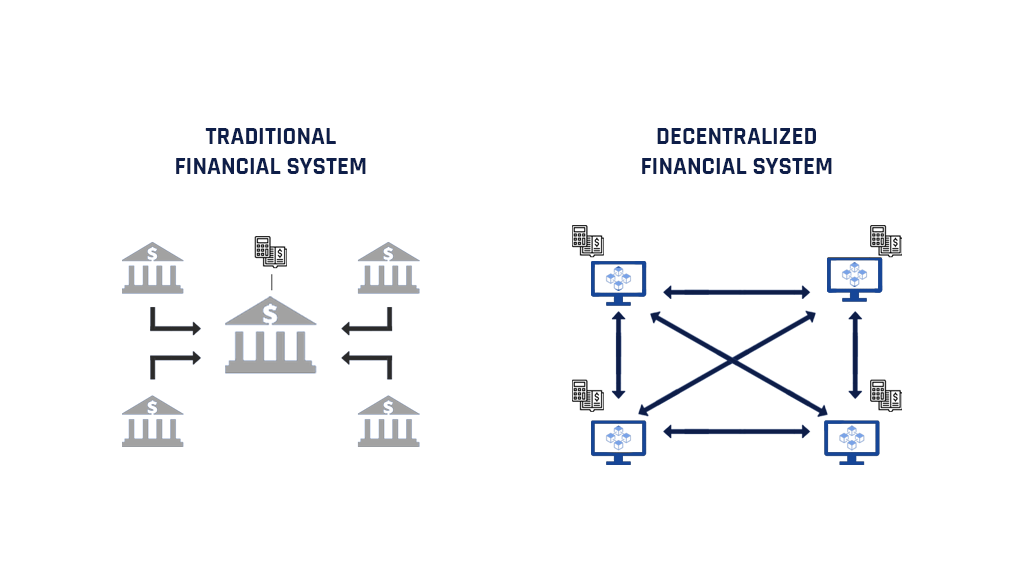

Decentralized finance (DeFi) is an emerging industry that promises to revolutionize the traditional finance sector. The need for an open, transparent, and secure financial system is the key driver backside the decentralized finance vs. traditional finance debate, so it does non come as a surprise that decentralized finance is slowly emerging as an culling to today's financial arrangement.

Decentralized finance, which is a blockchain-based concept, has the potential to disrupt traditional finance because of its ability to be a financial tool that is outside of government and regulatory command. The creation of completely decentralized and independent financial systems has since continued to get together pace among growing calls for data and privacy security.

What is Decentralized Finance?

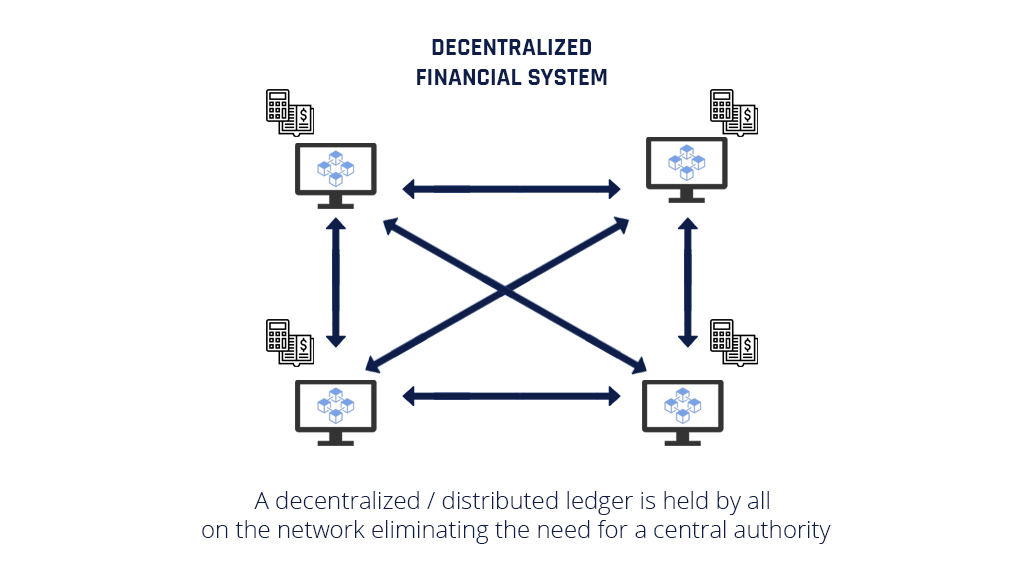

At its simplest, decentralized finance is an open fiscal sector that runs on software congenital on superlative of a public blockchain. Information technology involves the building of financial products and services on top of a blockchain with the aim of promoting or enhancing the evolution of an open financial system.

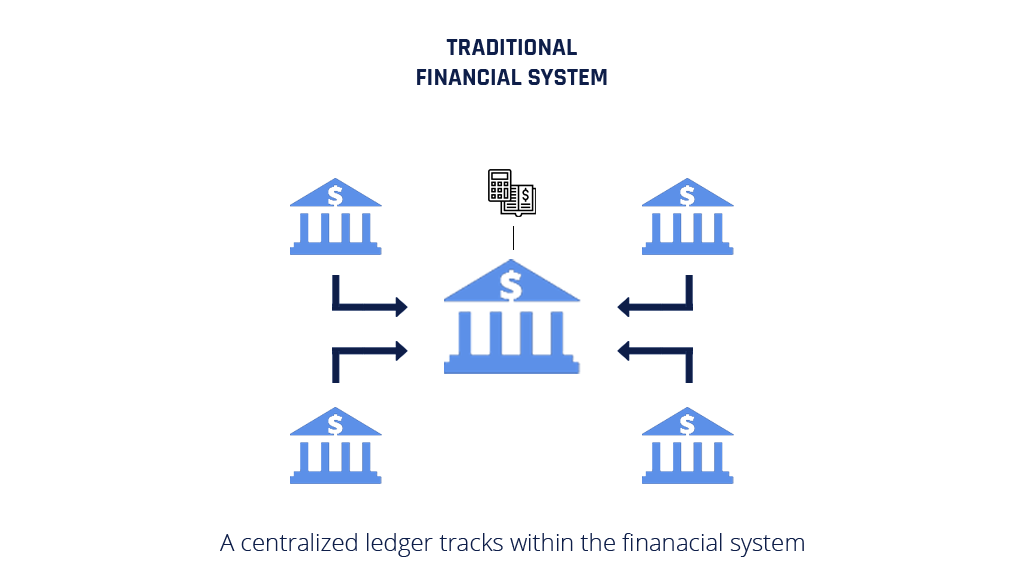

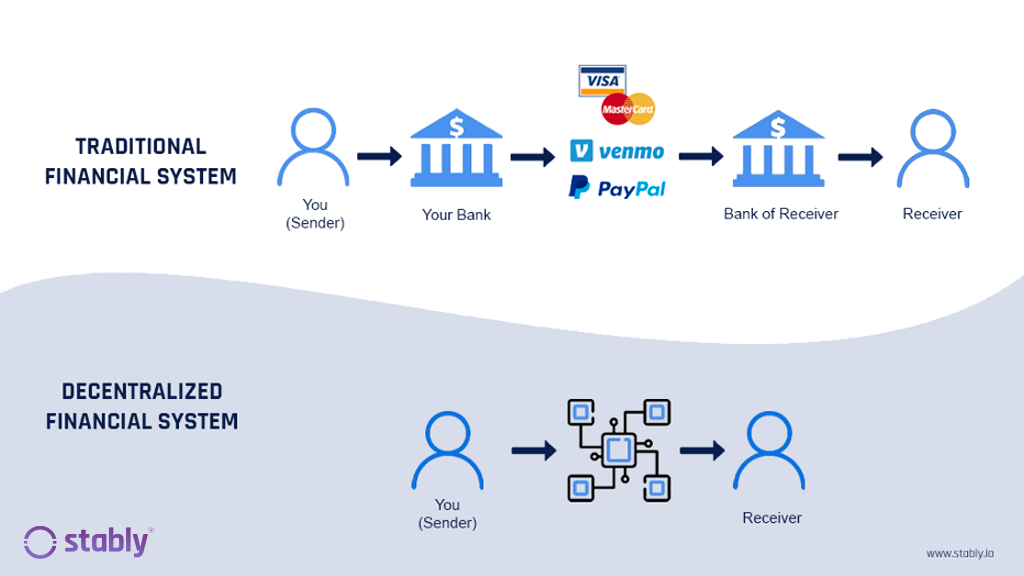

DeFi seeks to revolutionize the financial sector by acting equally an alternative to centrally-governed institutions, such every bit banks, that have historically acted equally financial intermediaries.

DeFi leverages a set of progressive, agile tools to give control to users. The fact that the new tendency offers extra functionality in improver to reducing operational risks makes it an ideal replacement to the current financial arrangement.

Decentralized finance started gaining prominence equally a replacement for the traditional finance system in 2018 when fifteen Ethereum-based projects came together with the aim of building an contained, secure, and open financial organization. Some of the early proponents behind the DeFi motion included MakerDao, Origin Protocol, and Prototype.

What Are the Differences?

Decentralized finance vs. traditional finance is hotly-debated topic. The two differ primarily on iii points.

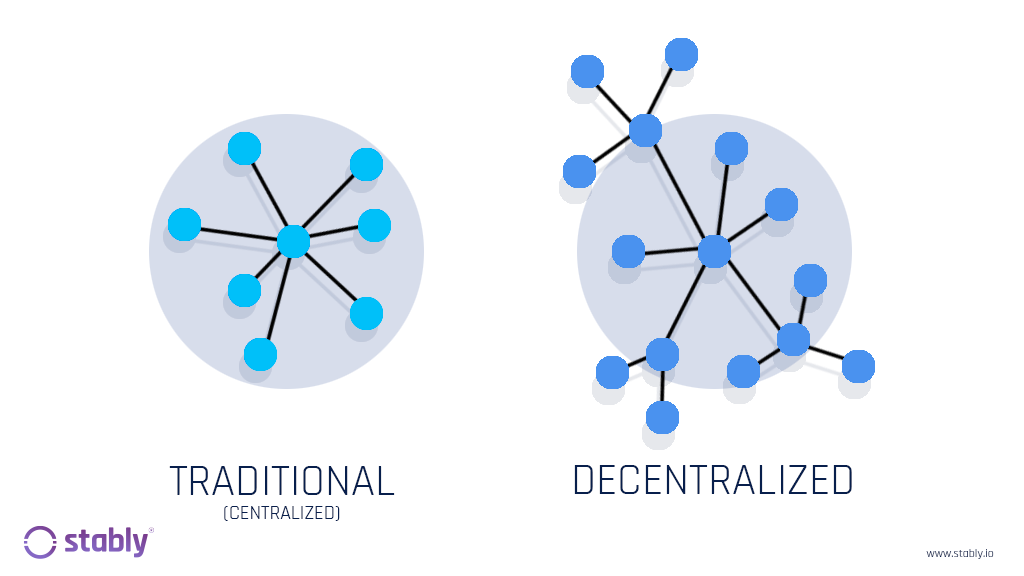

- In decentralized finance, a public blockchain acts equally the trust source, governing all operations in the financial sector. In contrast, public governance, which entails laws and licensed financial institutions, acts equally the trust source, governing all operations in the traditional finance.

- Decentralized finance continues to gain traction in role because it is a more than open and transparent than traditional finance. The lack of barriers to entry means everyone with programming skills can have part in building financial services and tools on top of public blockchains.

- In dissimilarity, cumbersome barriers to entry accept made information technology improbable for the traditional finance arrangement to comprehend the emerging trend. The fact that one must obtain proper licenses and authorization from regulators has express innovation around the traditional finance systems.

Decentralized Finance vs. Traditional Finance: Which One Stands Out?

Decentralized finance stands out as an alternative to traditional finance because it can do away with today'south fiscal hierarchy, which is a brunt of today's fiscal arrangement. The use of digital ledger technologies such as Ripple's XRapid has made it possible for people to gain full control of their avails and their personal fiscal data when transacting in the global financial sector.

The use of open up source code and developer tools presents a unique opportunity, equally developers would now exist able to experiment with more financial instruments equally decentralized finance continues to gather footstep. Developers will be able to work effectually the clock without restrictions, upgrading fiscal products and instruments in the financial sector.

Decentralized finance makes information technology possible for developers to come upwards with financial instruments capable of operating digital avails without limitations. Tokenization of pretty much everything from loans to collateral or debt obligations could also become a reality. The fact that blockchain technologies are accessible and transparent tin make the issuance of loans, repayments, and loan terms hands readable past machines and humans.

DeFi Use Cases

ane. Blistering services

Decentralized finance threatens to phase out traditional finance because of its ability to provide fiscal services without geographical barriers. Traditional finance has struggled to accomplish some remote parts of the earth, leaving billions without access to banking services.

Thanks to the integration of digital ledger technologies in applications, people in remote parts of the world tin now access banking services through their mobile devices. For that reason, DeFi promises to succeed in areas where traditional finance has failed.

2. Addressing global fiscal issues

Post-obit the 2008 Financial Crisis, many people lost their fortunes every bit a skillful number of banks went under. Concerned by the threat posed past the current global financial systems, many people are looking to emerging technologies to shield themselves.

Decentralized finance is also proving to be a reliable method of circumventing bug related to hyperinflation resulting from currency manipulation or unexpected devaluations, as is the case in China.

3. Circumventing Censorship and Restrictions

The popularity of decentralized finance continues to abound considering it could make it possible for people to circumvent bans or restrictions imposed by oppressive governments. The traditional financial sector comes with a lot of regulations and requirements that, at times, make it hard for people beyond borders to transact business.

The integration of blockchain engineering science into a number of financial products, such as Ripple, makes information technology possible for people to send and receive money without having to worry about bans or restrictions. The fact that people cannot track transactions with the utilise of digital ledger technologies makes it possible to complete transactions without having to worry about privacy violations by governments.

The ability to provide uncensored access to global financial services is one of the reasons why decentralized finance volition continue to stand up out from traditional finance. In a earth where people value their privacy, any production that makes it possible to avoid unethical privacy encroachments from authorities stands to be a successful ane.

The idea of building censorship-resistant products in the fiscal sector volition continue to fuel decentralized finance popularity.

4. Fiscal Creativity

Decentralized finance is likewise proving to exist a reliable tool for enhancing the development of financial products that in the past were the domain of large, licensed institutions. Financial derivatives, every bit well as futures and swaps products powered by digital ledger engineering science, could soon get a reality, given the amount of innovation around digital ledger technologies.

DeFi Apps

Even though decentralized finance is however in the early on stages of development as an alternative to the traditional finance system, a number of apps take already been developed. The apps are giving people a gustation of what the financial future could look like.

- DAI, with a userbase of 21,000 people, is ranked as the largest decentralized finance app. As the creator of the MakerDAO stablecoin, the app makes information technology possible for people to receive loans past depositing Ethereum. The app is completely decentralized.

- Dharma is another decentralized finance app that operates equally a lending platform. The app makes it possible for people to lend and borrow Ethereum, regardless of their credit score.

- Bancor Network is slightly different from the other two decentralized finance apps, as it allows users trade cryptocurrencies without an intermediary, such as a banker.

What are the Challenges?

Whatsoever good engineering science is always prone to challenges that may derail its adoption, and decentralized finance is no exception.

One of the biggest challenges that could terminate decentralized finance from replacing traditional finance organisation is the aspect of people being forced to trust unregulated open up-source code. The fact that anyone can access a source lawmaking powering a decentralized finance system means anyone tin can hack smart contracts and steal all the keys, which could result in people losing substantial amounts of money.

The applied science behind the decentralized finance application is still underdeveloped and unfriendly, and it will e'er be prone to vulnerabilities that would harm the technology'southward reputation.

The Bottom Line

While the use of digital ledger technologies in the global financial system is still in the early days, 1 cannot dispute this applied science's ultimate potential. Decentralized finance has what it takes to revolutionize the fiscal sector in a time of growing concerns about information and privacy security.

The fact that DeFi could result in and so many people gaining access to banking services in areas where traditional finance has failed underscores its massive potential.

Decentralized finance volition first have to address a number of issues pertaining to scalability, security, liquidity, and regulations if it is to replace today'south financial arrangement.

— — — — —

Subscribe!

Looking for news & updates from Stably? Join our Global Community on Telegram!

Follow us on social media:

Website | Twitter | Linkedin | Facebook | Telegram

Legal: legal@stably.io

Press: marketing@stably.io

Exchanges or Market place Makers: exchanges@stably.io

Partnerships: enterprise@stably.io

Investors: Kory Hoang, CEO — kory@stably.io

Source: https://medium.com/stably-blog/decentralized-finance-vs-traditional-finance-what-you-need-to-know-3b57aed7a0c2

0 Response to "3 Things You Need to Know About Business Finances"

Post a Comment