if i quit teaching what happens to my retirement

Didactics has long been ready upwards as something of a deal: relatively low salaries in exchange for generous retirement benefits — at least for those who remain in the classroom and in the same state for many years.

The idea is that this attracts people to the profession, knowing a secure retirement awaits, and gets them to stay long enough to collect on it.

But a number of reports have questioned that line of thinking, arguing that backloaded pensions are unfair to newer, short-time and more mobile teachers and fails as an constructive means of bounty.

A new paper from the Thomas B. Fordham Institute, a conservative education think tank, is the latest, arguing that teachers are getting a raw retirement deal. The Fordham research looked at the instructor retirement systems in the largest schoolhouse districts in all 50 states and the Commune of Columbia and found that teachers accept to wait an average of 25 years before the value of their pensions are larger than what they contribute themselves.

"Newly hired teachers in the majority of districts will be covered by retirement plans designed so that they will contribute more to retirement than the value of their benefits — for nearly an unabridged career," the study states.

The study advocates letting teachers cull between traditional pension programs and a 401(k)-way system.

Although the study at points overstates the extent to which some teachers are disadvantaged by prevailing retirement systems, it raises important points about whether pensions are an effective means for recruiting and keeping teachers.

Pensions 101

First, a quick primer on unlike forms of retirement:

Pensions, or defined benefit retirement programs, crave employees (teachers) and employers (school districts) to regularly contribute to a pension fund. When a teacher retires, he or she receives a regular payment (an annuity) for life, with the amount determined past a formula, usually based on years of teaching and last salary. Public sector pensions, like those collected by teachers, police officers and firefighters, are guaranteed by the taxpayer.

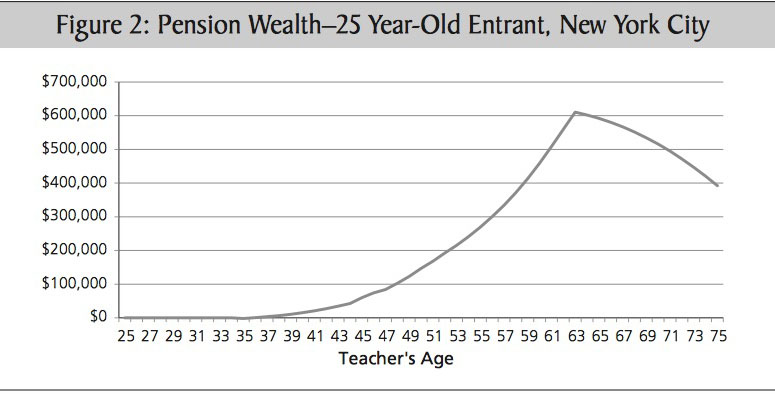

These programs are heavily back-loaded, significant that teachers retain nigh of the value of such a system late in their careers. (See, for example, the structure of New York City'southward organization beneath.) Teachers usually cannot take the full value of their pensions with them if they move to some other state. Teachers who quit too early on to benefit tin get a refund of what they contributed but ordinarily non of the employer contribution.

Photo: Manhattan Found

Defined-contribution systems, like 401(1000)south, create an individualized retirement account, in which a teacher's retirement benefit is simply the total contributions from the teacher and the employer, equally well as whatsoever interest from investments. These benefits accrue slowly over time and can move with the instructor between states. Upon retirement, the benefit lasts only equally long every bit the coin saved and the accrued involvement holds out and is non guaranteed by the government.

A number of states and districts use a combination of both systems.

Teachers heavily rely on these systems in gild to retire, specially the 40 percent who are not covered by Social Security.

The crossover betoken

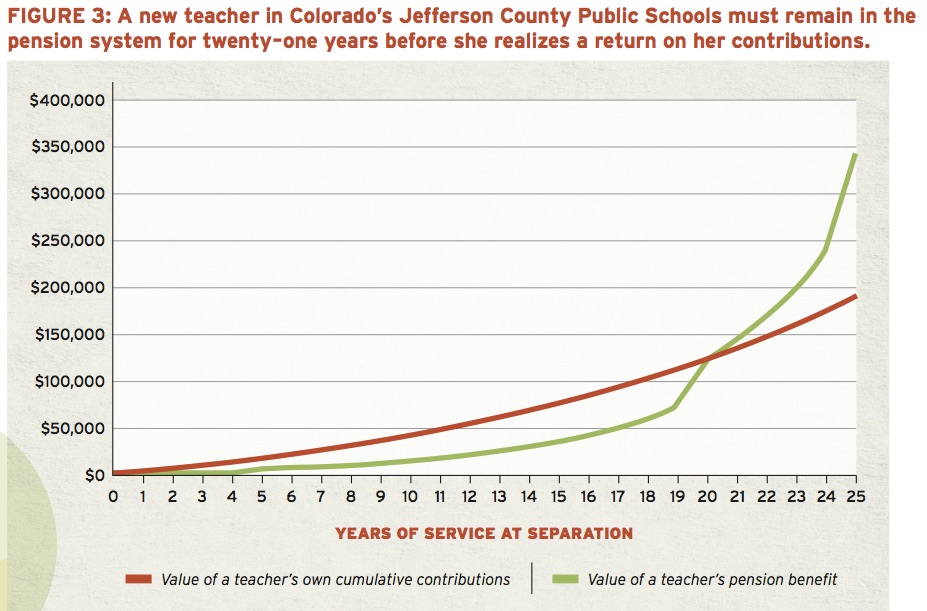

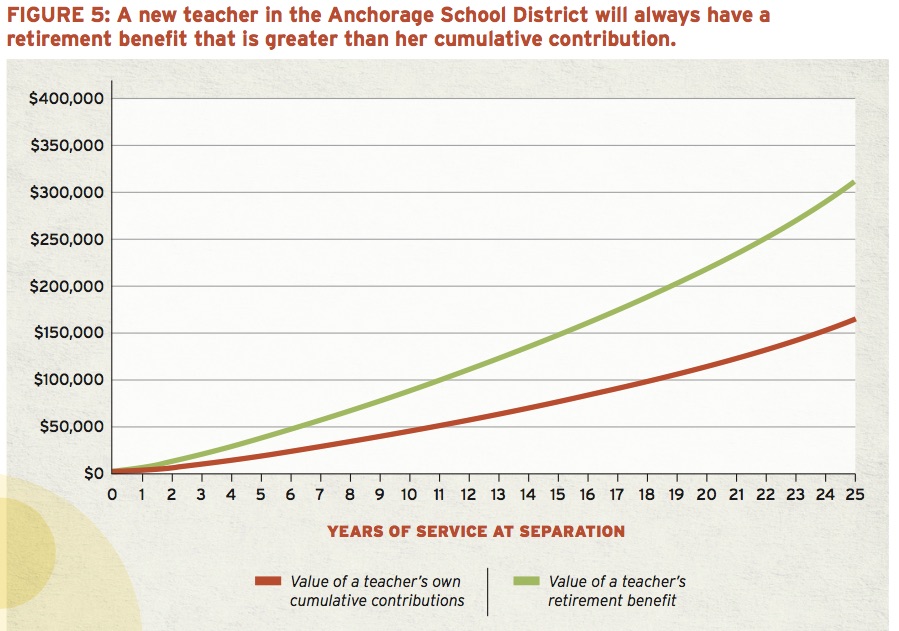

The Fordham paper calls the juncture at which teachers' retirement benefits are worth more than their own contributions the "crossover indicate." Nether most teacher pension systems, this doesn't happen for decades, nigh e'er more than twenty years, in some cases 30. In Boston, Chicago and Anoka-Hennepin County (Minnesota), teachers never cross over.

"Since the average experience of a teacher who leaves the profession is fifteen years — and fewer than ane out of 4 stays more than than twenty years — many teachers volition never come across a 'benefit,' " the report states.

In the half-dozen districts that offer defined-contributions programs instead of traditional pensions, the crossover occurs immediately. This is by design, every bit employer contributions are immediately credited to the instructor'south account.

The written report uses stark linguistic communication in describing these findings. "For a nation that places corking emphasis on disinterestedness, it is astonishing that and so many states at present tacitly endorse pension systems that are inequitable to current and future generations of new teachers," written report writer Martin Lueken writes.

The paper frames the back-loaded retirement systems as amounting to "pension theft."

"Any instructor who separates from the retirement system before the crossover in whatsoever of these districts will incur a loss on her contribution to the organization when she leaves," the study states.

But it's not quite right that teachers actually lose coin under this system, since every bit the written report acknowledges at another point, "Of course, no thing when [a teacher] leaves she can choose to 'cash out' and receive a refund," usually with interest.

Dara Zeehandelaar, research manager at Fordham, said in an interview, "Our definition of a loss is [when] what you put in at present is worth less than your expected benefit in the futurity" — in other words, the crossover point.

She acknowledged that "[teachers] can break even with a refund" merely noted that many teachers may not realize that a refund is a better deal than taking a pension. Zeehandelaar said she wasn't enlightened of any available data quantifying how many teachers accept refunds over pensions.

Salubrious vs. harmful turnover

The Fordham written report argues that heavily back-loaded traditional pensions harm the quality of the instructor workforce by interfering with good for you turnover: "The [defined contribution] programme does not penalize mobile teachers or those who decide teaching is non for them. Nor does it incentivize veterans to stay in a system for financial reasons, even if they're ready to leave."

Supporters of pensions fence that lower turnover is a feature, non a issues.

Teresa Ghilarducci, a labor economist at the New School, said pension systems can exist thought of as large bounty premiums for very experienced teachers that provide incentive for people to keep teaching. Since teachers generally improve over fourth dimension and compunction can harm pupil achievement, this may do good students.

A 401(k)-style organisation, simply put, gives more than money to teachers who remain in the system for less time, while a pension organisation rewards longevity, at to the lowest degree up to a point.

"To give money to people who are brusque stayers by having a defined-contribution design may hateful that you accept to cede the pensions of people who stay for a long fourth dimension," said Ghilarducci.

Pensions as well create a strong incentive for teachers to go out subsequently they hitting retirement age, every bit pension wealth really starts decreasing from there. Ghilarducci argues that this may help push out teachers who are burned out or declining in effectiveness.

Retirement benefits and rationality

Much of this assumes that teachers are cognizant of and rationally act upon changes in their retirement benefits, and the testify is somewhat mixed on this forepart.

Ghilarducci points to survey data showing that teachers say they value their pensions. And this is surely true to some extent. Simply inquiry finds that teachers value salary much more than retirement wealth. A study conducted later Illinois allowed teachers to pay into the system in order to receive additional benefits plant that teachers were willing to pay only 20 cents on average in society to obtain a dollar's worth of pension value. This suggests that teachers don't value retirement benefits at nigh every bit much as they price.

These results, concluded study writer Maria Fitzpatrick of Cornell, "bandage dubiety on the ability of deferred compensation schemes to concenter employees."

This is peradventure because some teachers are poorly informed about how valuable their pensions really are.

In line with this view, Fordham recommends that districts "reduce [teacher retirement] do good levels and increment wages."

Cory Koedel, an economist at the University of Missouri, said that although in that location isn't much research on whether pensions work every bit a recruitment tool, studies on retentivity show surprisingly small effects.

Although in that location is some evidence that pensions reduce early career turnover among teachers relative to similar professions — similar nurses, social workers and accountants — other research shows that such retirement plans don't seem to have a big impact on teacher retentivity.

"Theoretically, there's a very potent case that pensions should increase retention" of teachers in the middle or late stages of their career, said Koedel. "But about teachers in that point of their career don't move jobs anyway."

Pensions do appear to lead teachers to retire at an earlier age than other professionals — social workers, nurses and accountants — merely pushing effective veteran teachers to exit may be harmful. Both sides of the debate say their system is better for removing veteran teachers who may be burned out: Pension advocates say the incentives to go out after retirement age do and then; skeptics say such teachers are "locked in" in the years leading up to retirement.

Studies that effort to net out how the quality of the teacher workforce would change, depending on unlike retirement systems, come to unlike conclusions. Some — depending on how switches affect teacher turnover — find that traditional pensions are preferable, but others don't.

Ane report examined Washington state'southward switch from a defined-do good system to a hybrid that included a 401(k)-similar attribute — the modify did not seem to have any outcome on teacher attrition.

Other studies suggest that forepart-loaded salaries may be best for recruiting and retaining effective teachers.

Portability is as well an result. The Fordham study points out that pensions exact a steep penalty on teachers who motion between states. Ghilarducci agrees that pensions should become more movable. Enquiry finds that the lack of pension portability likely contributes to low teacher mobility betwixt states, which in turn may reduce pupil achievement by weakening the teacher hiring pool.

The politics of pensions

The Fordham study calls for districts with a alimony system to allow teachers to opt for either a divers-benefit or a defined-contribution organisation.

"Benefits would be tied directly to contributions and teachers would have access to employer contributions in addition to their own," the report states. "Moreover, this would afford all teachers an opportunity to relieve toward a secure retirement and cull the plan that fits their ain life circumstances, career goals, and preferences."

Unmentioned are some of the bug with defined-contribution programs like 401(k)south. A recent Wall Street Journal story establish that some of the creators of 401(k)s now regret that they have largely replaced pensions. Critics indicate to high management fees and market place volatility.

"In a defined-contribution plan, the risk is borne past the individual," said Zeehandelaar of Fordham. "In a defined-benefit program, the risk is borne by the system or the taxpayers."

Pension plans create a political risk of underfunding during economical downturns, every bit politicians may be able to ignore pension obligations in the short term, realizing that the pecker will come due long later they're out of office.

"That's a problem, and [states] should bind themselves to full funding," said Ghilarducci, noting that some, though not nearly, states have washed then. Georgia, for instance, has a ramble amendment that requires the state to fund the ongoing costs of its pensions.

Of course, the same political incentives that lead to underfunding may also deter politicians from putting in identify such measures. A national study institute that 10 percentage of all coin spent on teacher bounty is going toward older pension liabilities — that ways either less coin spent in classrooms for textbooks or current teacher salaries, or else higher taxes. Places similar Chicago, Detroit and California have placed huge strains on schools and taxpayers for exactly that reason.

At the aforementioned time, shifting the risk onto teachers has its own downsides: For one matter, their retirements would be less secure, and for another, the value of teachers' retirement compensation would take a hit, maybe making the profession less desirable.

In some instances, pension critics admit this: A recent web log post from the Fordham Institute argued that teachers' pay is much college than unremarkably perceived because of their "adventure-gratis" retirement packages with loftier rates of return guaranteed by the government.

It's true that the traditional pension "deal" may be nothing of the sort for many teachers or the public, and enquiry suggests that teachers don't react to pension incentives in the way advocates may have hoped But how teachers would respond to a shifting of risk through a 401(yard)-style arroyo remains something of an open question.

Source: https://www.the74million.org/article/are-traditional-retirement-systems-the-right-fit-for-todays-teachers/#:~:text=When%20a%20teacher%20retires%2C%20he,are%20guaranteed%20by%20the%20taxpayer.

0 Response to "if i quit teaching what happens to my retirement"

Post a Comment